So lately you’ve been sitting on this brilliant business/side-hustle idea and you keep telling yourself you can’t launch it because you don’t know how to register the business.

Well, hopefully with this article that excuse is going to the dust as I show steps to register your business via CRA – Canada Revenue Agency. (Obviously, this is based on the assumption that your business is Canada-based.)

But before jumping into the steps, do you even wonder why you should consider starting a side-hustle/business?

Benefits of starting a side-hustle/business

If I were to provide an exhaustive list why you should consider starting a side hustle/business, you’ll probably be reading this article from sunset till sunrise. But I’d rather not have you do that :-); so here are a few:

- Earn more money to meet your growing financial needs

- Provide more value and service to the world

- Grow your impact/influence

- Make more money to increase your savings & investment portfolio

- Have more to donate to causes that you believe in

- Gain a sense of fulfillment (that’s if you’re doing something you love)

- Clench control of your time

- Boost your chance of reaching F.I.R.E

- Get tax breaks

And the list goes on…

Registering your business

Hopefully, it makes sense for you to look into starting something. For taxation purpose, you want to declare your income and expenses, if you operate a business, this way you may be eligible for some returns/tax break depending on how the business is structured.

That said, here is a guide to follow to register a business (mostly applicable for sole proprietorship) via CRA.

(PS if you plan to register a corporation, it’s best to do that on the Corporations Canada site .)

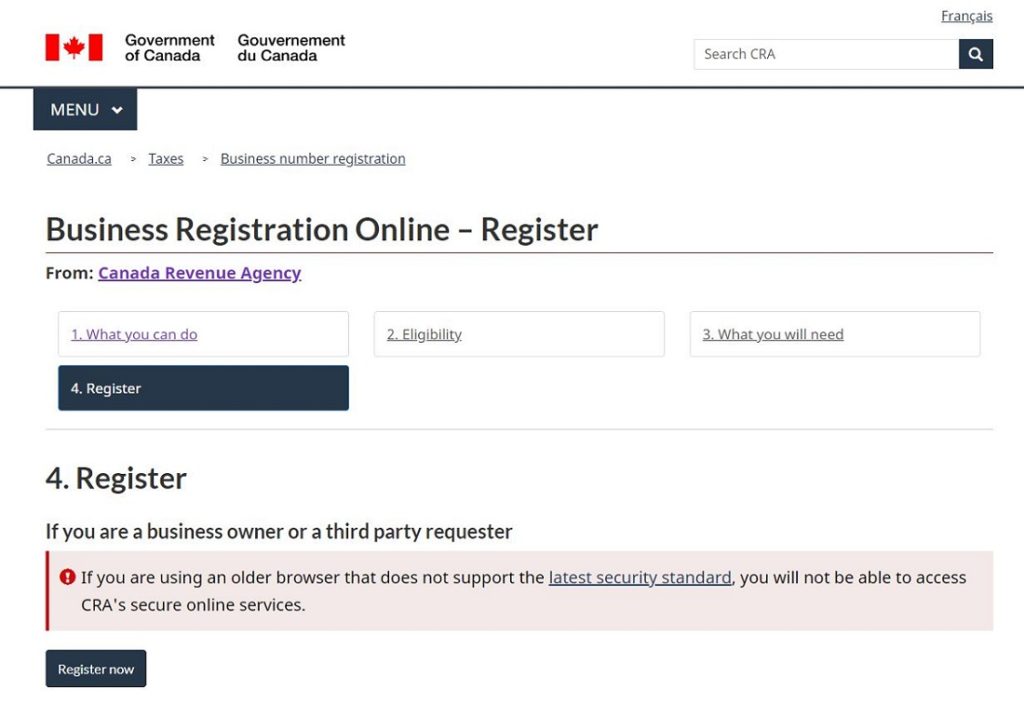

- Follow the Business Registration Online link and peruse through the info (#1 – #3) there to have a better understanding. Once done, move onto step #4 ad click the ‘Register Now’ button.

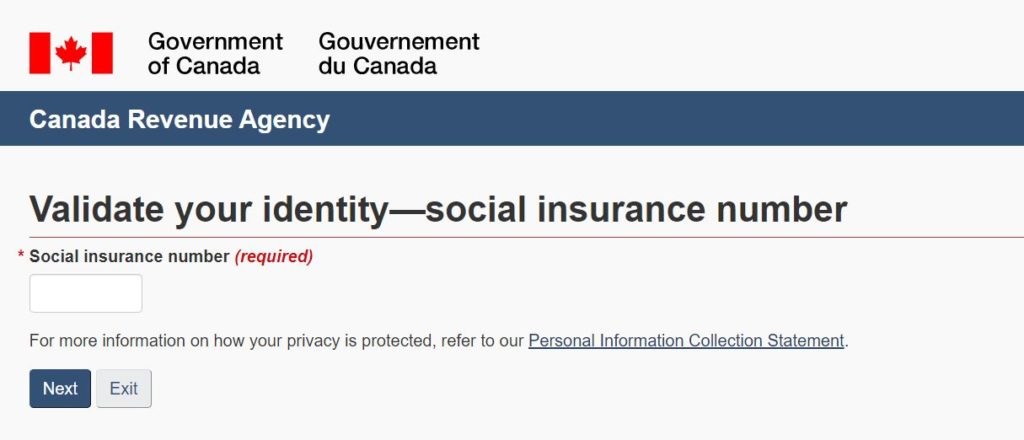

2. Enter SIN # for identity purpose

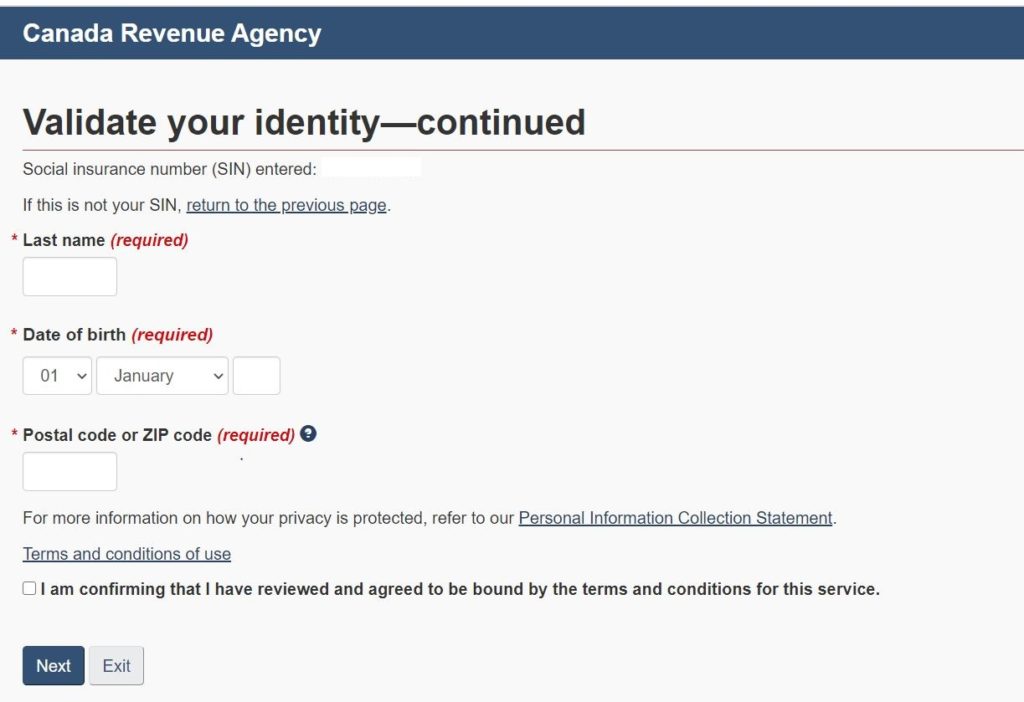

3. Enter some more personal info

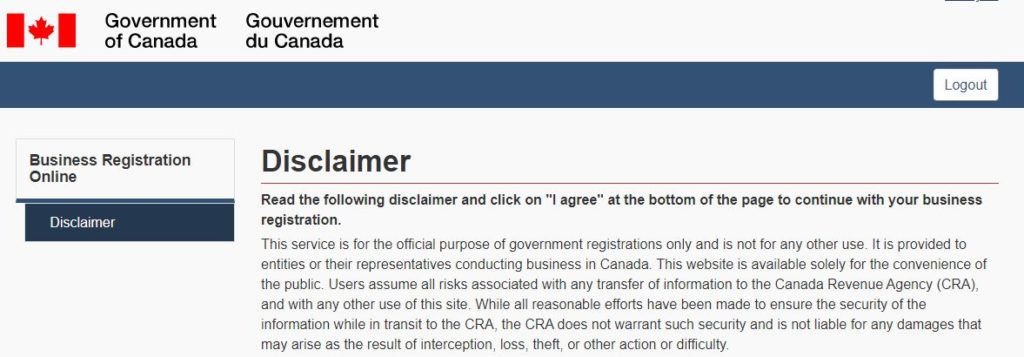

4. Agree to disclaimer (read through then move to next page)

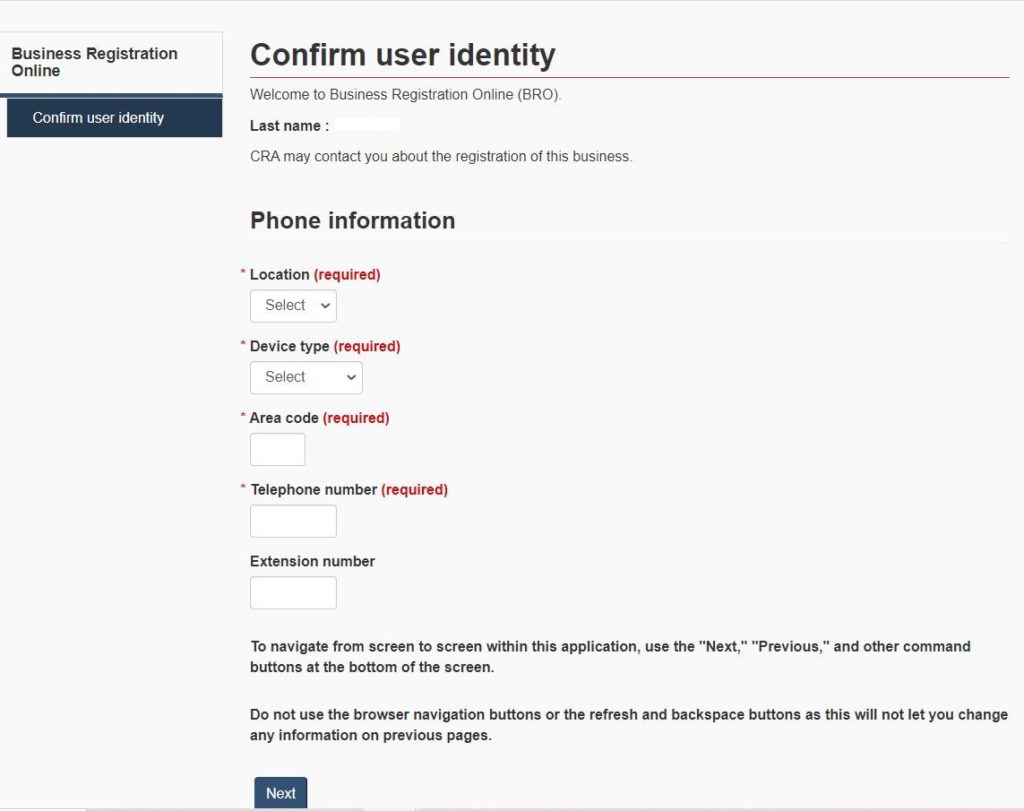

5. Confirm your identity

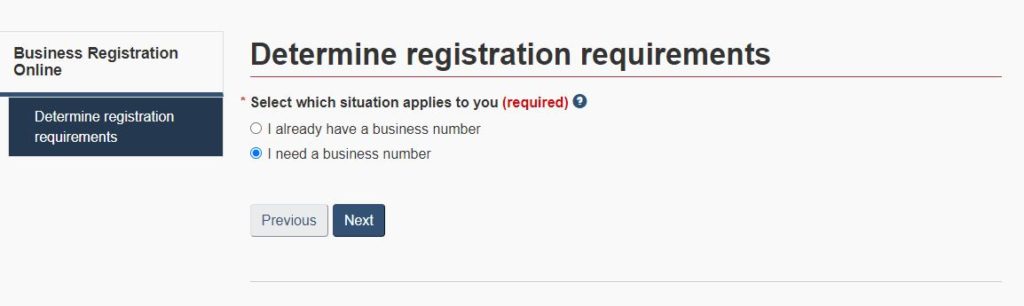

6. Question about business number (2nd option if you don’t already have one)

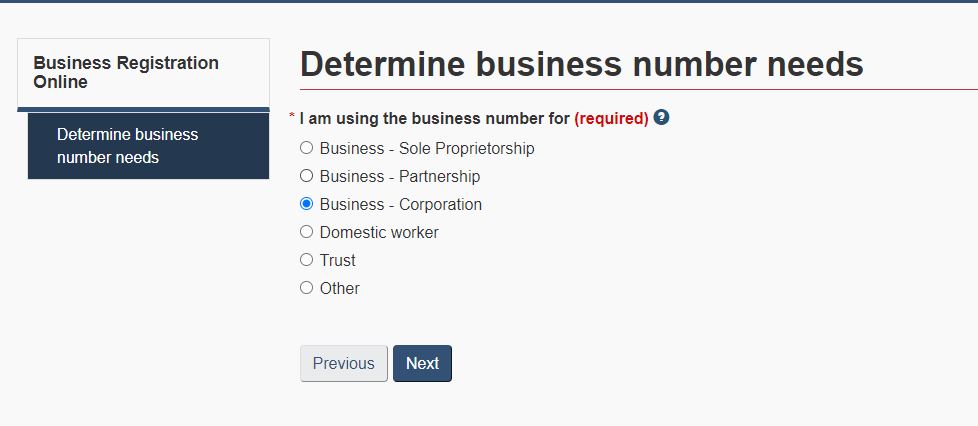

7. Select business type . (As mentioned earlier, if you plan to register a corporation, it’s best to do that on the Corporations Canada site .)

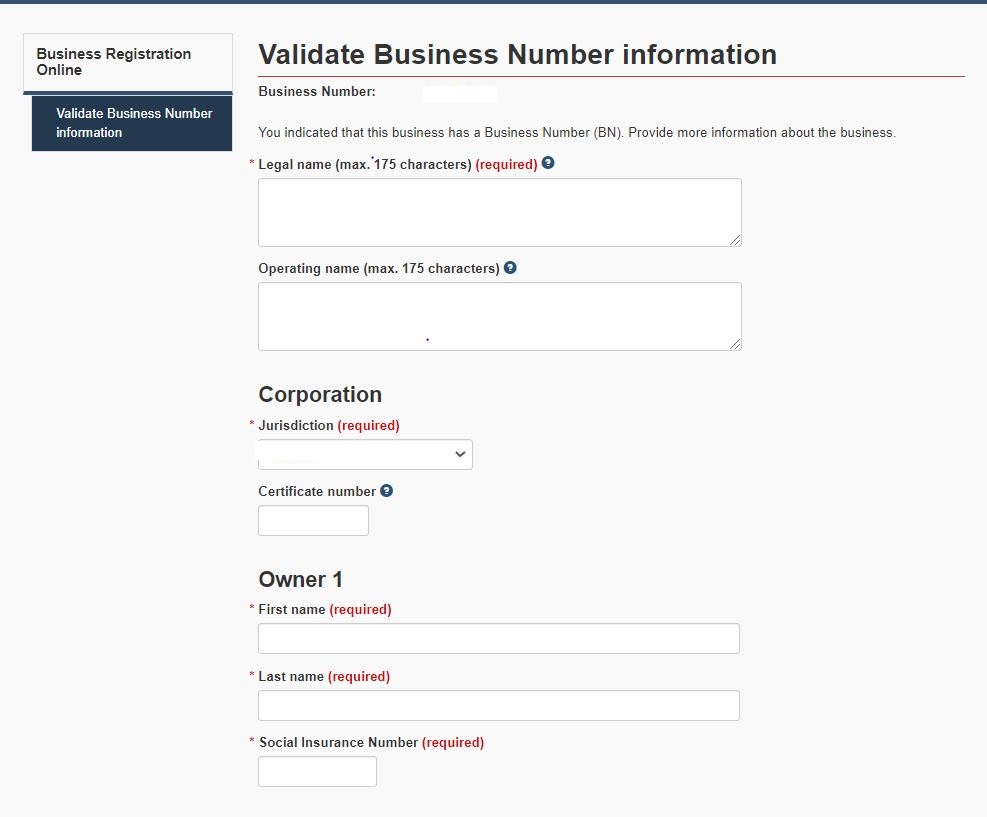

8. You will be assigned a 9 digit business number in subsequent screens. You will then have to provide some info about the business

9. Next steps should be more of verification. On one of the screens, you will be asked whether you project to earn more than $30,000 within a quarter/year. If yes, then you’ll be required to register for a GST/HST account; this allows you to get remitted for GST/HST taxes on your business expenses. You can find the link to register for that here.

Once completed with the entire process, you’ll be able to print out a pdf document outlining important info about your new business. Save that document for your record as you may need to provide the business number most times to receive payment as a business owner.

And that’s it. The procedure is quite straightforward and I hope you don’t face any blockers.

I wish you all the best in your side hustle endeavors.

To success in your side hustle/business!!