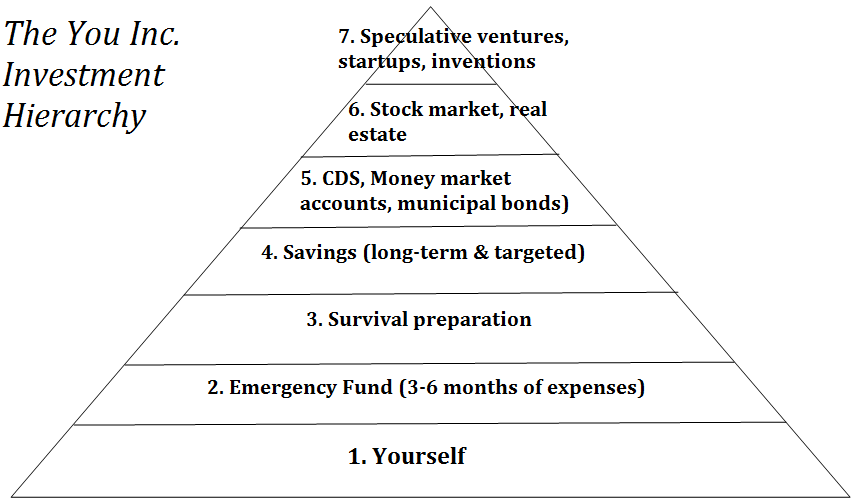

You’ve probably heard the saying, “pay yourself first”, but then do you have an idea of what that entails? Into what kind of investments do you direct your hard-earned money? In this article, I share the You Inc. Investment Hierarchy which I’ve gleaned from The Financial Fitness written by bestselling authors, Chris Brady and Orrin Woodward (you check out my review on the book here). The 1st four levels of the hierarchy are not risky while the rest are to some degree.

Without further ado, here is the You Inc. Investment Hierarchy:

Level 1: Yourself

This level, according to the book, “… is the first focus of good investment and the foundational level of the You Inc. investment”. It’s basically investment in your personal and professional development (e.g. in areas of leadership, business ownership/entrepreneurship, financial wisdom, career advancement skills, etc). You may lose your business, your properties, your money, your flashy cars, etc, but you’ll never lose the wisdom/knowledge with which you had acquired those assets.

Level 2: Emergency fund

Unforeseen events can come up; you or a loved one may need to undergo an emergency medical procedure, or you may need to fix that roof which got cracked or, at worst, torn down, etc. These occurrences usually aren’t cheap and may call for urgent resolution. And that’s where the emergency fund comes in. Here the authors strongly recommend maintaining at least 3-6 months of expenses based on your income and assets in order to weather those unexpected storms if/when they rear their big heads.

Level 3: Survival preparation

After meeting the requirements for Level 3, the authors suggest directing some portion of saving into survival preparation fund. This fund is in anticipation of terrible or catastrophic happenings such as earthquake, hurricane, banks closing which actually occurred during the Great Depression (those who “impounded” their money during that period survived it). In the words of the authors, “don’t be fanatical about this, but don’t ignore in either.”

Level 4 : Long-term and targeted savings

The long-term saving will be money you pay yourself first and never touch (this is more so for financial freedom). On the other hand, the targeted saving comprises money you put aside to spend later on items such as cars, children’s education and investments, new house, vacation trips, etc. If you have no debt, the authors advise pumping in more money into these savings. Orrin proposes cutting down expenses and revving up income to the extent that you can live on at most 75% of your net income for a start and then dipping that number to 50% later on.

Level 5 : Secure investments

This is the level where risk comes into the picture. Investments that qualify for this level are usually of lower risk, but they produce low interest; this includes investments such as money market account and municipal bonds.

Level 6 : Real Estates and stocks

For those who deal in these areas the authors encourage investing here after gaining expertise through trial and error, and mentorship. However, for people who have no mastery in these areas, the authors strongly suggest investing in these areas only the amount they are willing to lose and, in fact, only after they’ve solidified their foundations in the previous levels.

Level 7: Other speculation

This is the level where people want you to invest in their projects or businesses, seeing that you’re very prosperous. The authors firmly warn against investing in areas where you haven’t mastered and done due diligence researching. Their one advice here is to never use your savings to speculate.

And that’s it – the You Inc. Investment Hierarchy.

The authors made it clear that they practice these principles which they strongly believe are key to achieving financial success.

To your financial success!!!