“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.” –Dave Ramsey

We live in an economic planet where everything around you is the product of money. From the clothes you wear to the house you live in, the car you drive, the food you eat – and just everything.

For that reason, you will agree with me that it makes sense for us to have a good understanding of the basics of money to take charge of our finances.

To help with that, here’re 7 top books on personal finances you want to check out:

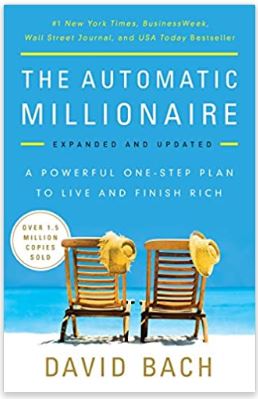

1. The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich

In this best selling book by David Bach, you will learn how to get your financial runway laid down for financial freedom. The amazing thing about the plan is that you don’t need: ·a budget ,no willpower, not a lot of money, no interest in money itself. The author show how to achieve put your finances in order automatically (doohh! that’s intended from the book’s title) .

David Bach is also the author of other popular books including: Smart Couples Finish Rich , Smart Women Finish Rich , amongst many others.

Get a copy of “The Automatic Millionaire”

2. I Will Teach You to Be Rich: No Guilt. No Excuses. No BS 6-week program

“Buy as many lattes as you want. Choose the right accounts and investments so your money grows for you—automatically. Best of all, spend guilt-free on the things you love.”

That’s what the author, Ramit Sethi, will share when you finish reading the book. Along with that, he touches on

• How to set up no-fee, high-interest bank accounts that won’t gouge you for every penny

• How Ramit automates his finances so his money goes exactly where he wants it to—and how you can do it too

• How to talk your way out of late fees (with word-for-word scripts)

• How to save hundreds or even thousands per month (and still buy what you love)

• A set-it-and-forget-it investment strategy that’s dead simple and beats financial advisors at their own game

• How to handle buying a car or a house, paying for a wedding, having kids, and other big expenses—stress free

• The exact words to use to negotiate a big raise at work

Get a copy of “I Will Teach You To Be Rich”

3. MONEY Master the Game: 7 Simple Steps to Financial Freedom

After interviewing over 50 of the world’s top financial experts (folks like Warren Buffet, Ray Dalio, etc), Tony Robbins formulated a 7-step blueprint to reaching financial freedom.

“Tony Robbins walks readers of every income level through the steps to become financially free by creating a lifetime income plan. This book delivers invaluable information and essential practices for getting your financial house in order.”

Get a copy of “Money: Master The Game”

4. The Total Money Makeover: A Proven Plan for Financial Fitness

Written by America’s favorite finance coach, Dave Ramsey shows how to turn your financial flabs/fats into financial muscles.

The Total Money Makeover: Classic Edition, you’ll be able to:

- Design a sure-fire plan for paying off all debt—meaning cars, houses, everything

- Recognize the 10 most dangerous money myths (these will kill you)

- Secure a big, fat nest egg for emergencies and retirement!

So, if you want to get financially ripped, be sure to check out this book.

Get a copy of “The Total Money Makeover”

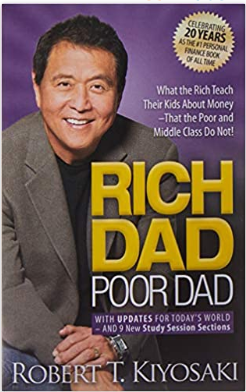

5. Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not

As one of the world’s renowned financial educator of our time, Robert Kiyosaki, shares his experience from his rich dad and poor dad. How his money and investing mindset was shaped by his interactions with both and lesson he had acquired.

In Rich Dad Poor Dad, the author:

• Explodes the myth that you need to earn a high income to become rich

• Challenges the belief that your house is an asset

• Shows parents why they can’t rely on the school system to teach their kids

about money

• Defines once and for all an asset and a liability

• Teaches you what to teach your kids about money for their future financial

success

Get a copy of “Rich Dad Poor Dad”

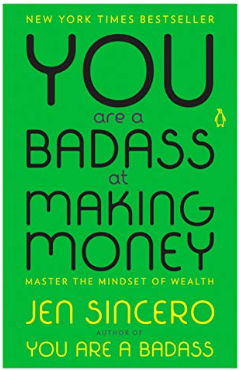

6. You Are a Badass at Making Money: Master the Mindset of Wealth

Mixed with humor and lots of wisdom, Jen Sincero shares how to get rid of self limiting beliefs and lays out guides for transformation so you can achieve the financial abundance you desire.

The book covers how to:

• Uncover what’s holding you back from making money

• Give your doubts, fears, and excuses the heave-ho

• Relate to money in a new (and lucrative) way

• Shake up the cocktail of creation

• Tap into your natural ability to grow rich

• Shape your reality—stop playing victim to circumstance

• Get as wealthy as you wanna be

Get a copy of “You Are A Badass At Making Money”

7. Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

Whether you’re aware of it or not, you have a relationship with money. And to excel financially, that relationship has to be a good one. And this book shows how.

Some topics touched on include:

• Get out of debt and develop savings

• Save money through mindfulness and good habits, rather than strict budgeting

• Declutter your life and live well for less

• Invest your savings and begin creating wealth

• Save the planet while saving money

Get a copy of “Your Money Or Your Life”

And that’s it.

What other books on personal finances do you recommend?

To your personal finance!

[Full Disclosure: As an affiliate, I may receive compensation if you purchase through links referenced in this article at no extra cost to you.]